The Best Strategy To Use For Hsmb Advisory Llc

The Best Strategy To Use For Hsmb Advisory Llc

Blog Article

The Single Strategy To Use For Hsmb Advisory Llc

Table of ContentsThe Basic Principles Of Hsmb Advisory Llc Fascination About Hsmb Advisory LlcRumored Buzz on Hsmb Advisory LlcWhat Does Hsmb Advisory Llc Mean?Some Known Factual Statements About Hsmb Advisory Llc Hsmb Advisory Llc Fundamentals Explained

Ford states to avoid "cash worth or irreversible" life insurance policy, which is even more of an investment than an insurance. "Those are extremely made complex, come with high payments, and 9 out of 10 people do not need them. They're oversold due to the fact that insurance agents make the largest compensations on these," he states.

Handicap insurance policy can be expensive, nonetheless. And for those that select lasting treatment insurance coverage, this policy might make impairment insurance coverage unnecessary. Review a lot more concerning lasting care insurance policy and whether it's best for you in the following area. Long-lasting treatment insurance policy can assist pay for costs related to long-term care as we age.

Hsmb Advisory Llc Fundamentals Explained

If you have a persistent wellness problem, this sort of insurance policy might wind up being critical (St Petersburg, FL Life Insurance). However, do not let it worry you or your savings account early in lifeit's normally best to take out a policy in your 50s or 60s with the anticipation that you won't be utilizing it till your 70s or later.

If you're a small-business owner, consider protecting your livelihood by purchasing service insurance coverage. In the occasion of a disaster-related closure or duration of rebuilding, service insurance can cover your earnings loss. Take into consideration if a significant climate event impacted your storefront or manufacturing facilityhow would that impact your earnings? And for for how long? According to a report by FEMA, in between 4060% of local business never ever reopen their doors adhering to a catastrophe.

Plus, utilizing insurance might in some cases cost greater than it conserves over time. For instance, if you get a chip in your windshield, you may consider covering the repair expense with your emergency financial savings instead of your vehicle insurance policy. Why? Because utilizing your automobile insurance policy can cause your monthly costs to rise.

The 7-Minute Rule for Hsmb Advisory Llc

Share these ideas to protect liked ones from being both underinsured and overinsuredand seek advice from a relied on expert when required. (https://hsmbadvisory.weebly.com/)

Insurance that is bought by a specific for single-person protection or coverage of a family members. The specific pays the premium, instead of employer-based health insurance coverage where the company commonly pays a share of the premium. Individuals might buy and purchase insurance policy from any strategies offered in the individual's geographical area.

People and families might get approved for financial support review to decrease the price of insurance premiums and out-of-pocket expenses, yet only when registering via Connect for Health Colorado. If you experience specific changes in your life,, you are eligible for a 60-day amount of time where you can enlist in a specific plan, even if it is beyond the yearly open enrollment period of Nov.

Our Hsmb Advisory Llc Statements

- Connect for Wellness Colorado has a complete checklist of these Qualifying Life Occasions. Dependent children that are under age 26 are qualified to be included as relative under a parent's coverage.

It might seem simple but comprehending insurance coverage kinds can likewise be perplexing. Much of this complication comes from the insurance industry's recurring objective to make personalized insurance coverage for policyholders. In creating adaptable plans, there are a range to select fromand all of those insurance kinds can make it hard to comprehend what a certain plan is and does.The 4-Minute Rule for Hsmb Advisory Llc

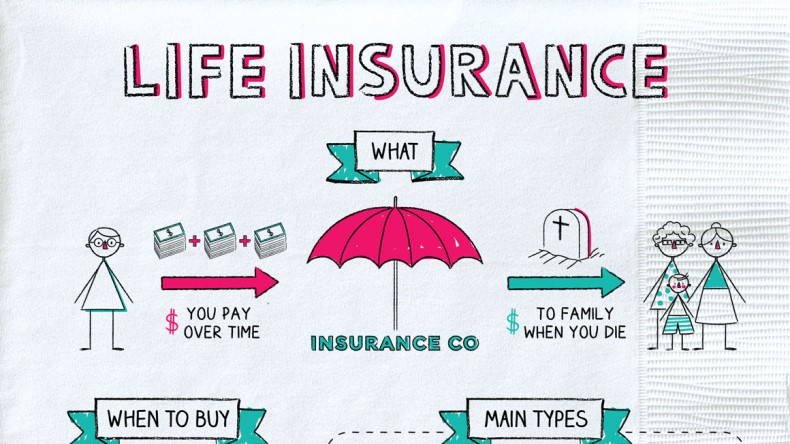

The most effective location to start is to discuss the distinction between both kinds of fundamental life insurance coverage: term life insurance policy and irreversible life insurance. Term life insurance policy is life insurance coverage that is just active temporarily period. If you pass away throughout this period, the individual or individuals you've called as beneficiaries may obtain the cash money payout of the policy.

Lots of term life insurance policies let you transform them to an entire life insurance policy, so you don't lose protection. Commonly, term life insurance policy policy premium repayments (what you pay each month or year right into your plan) are not locked in at the time of purchase, so every five or 10 years you have the plan, your costs might rise.

They likewise have a tendency to be cheaper general than whole life, unless you purchase an entire life insurance policy plan when you're young. There are likewise a couple of variants on term life insurance. One, called team term life insurance policy, prevails amongst insurance policy choices you may have access to via your company.Unknown Facts About Hsmb Advisory Llc

This is usually done at no charge to the employee, with the ability to buy extra protection that's gotten of the employee's income. One more variation that you might have accessibility to with your company is extra life insurance policy (Health Insurance). Supplemental life insurance policy can consist of unintentional fatality and dismemberment (AD&D) insurance, or interment insuranceadditional coverage that might aid your family members in case something unanticipated happens to you.

Irreversible life insurance simply refers to any type of life insurance coverage plan that doesn't end.

Report this page